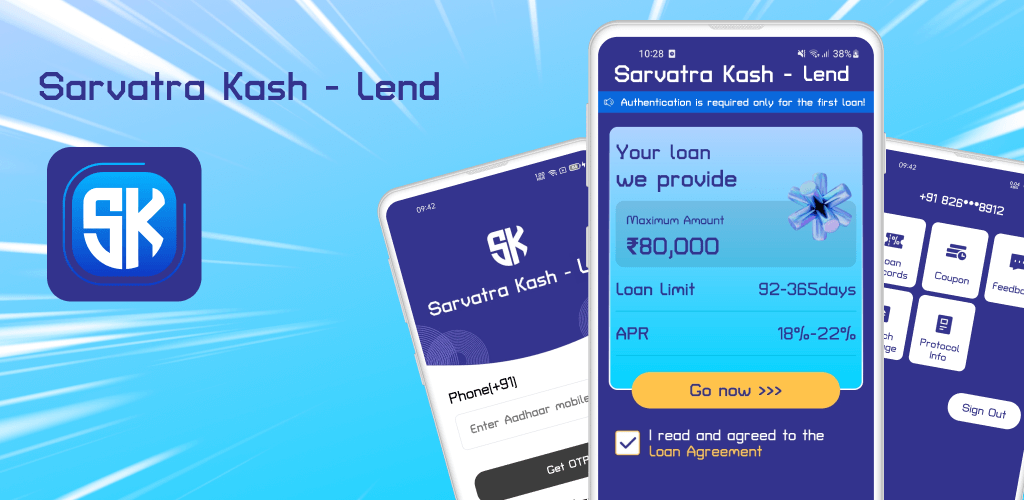

Product Overview

Sarvatra Kash - Pro connects eligible users to RBI-compliant personal credit services through regulated financial institutions. Our technology platform facilitates secure digital lending processes with full transparency.

Facilitated by RBI-Licensed NBFC Partner PKF Finance Limited

Key Features

▸ Credit Range: Access funds from ₹5,000 to ₹80,000

▸ Flexible Tenure: Repayment periods between 92 days to 365 days

▸ Transparent Pricing: APR 18% to 22% | Daily Interest Rate: 0.05% to 0.06% | No prepayment penalties or hidden costs

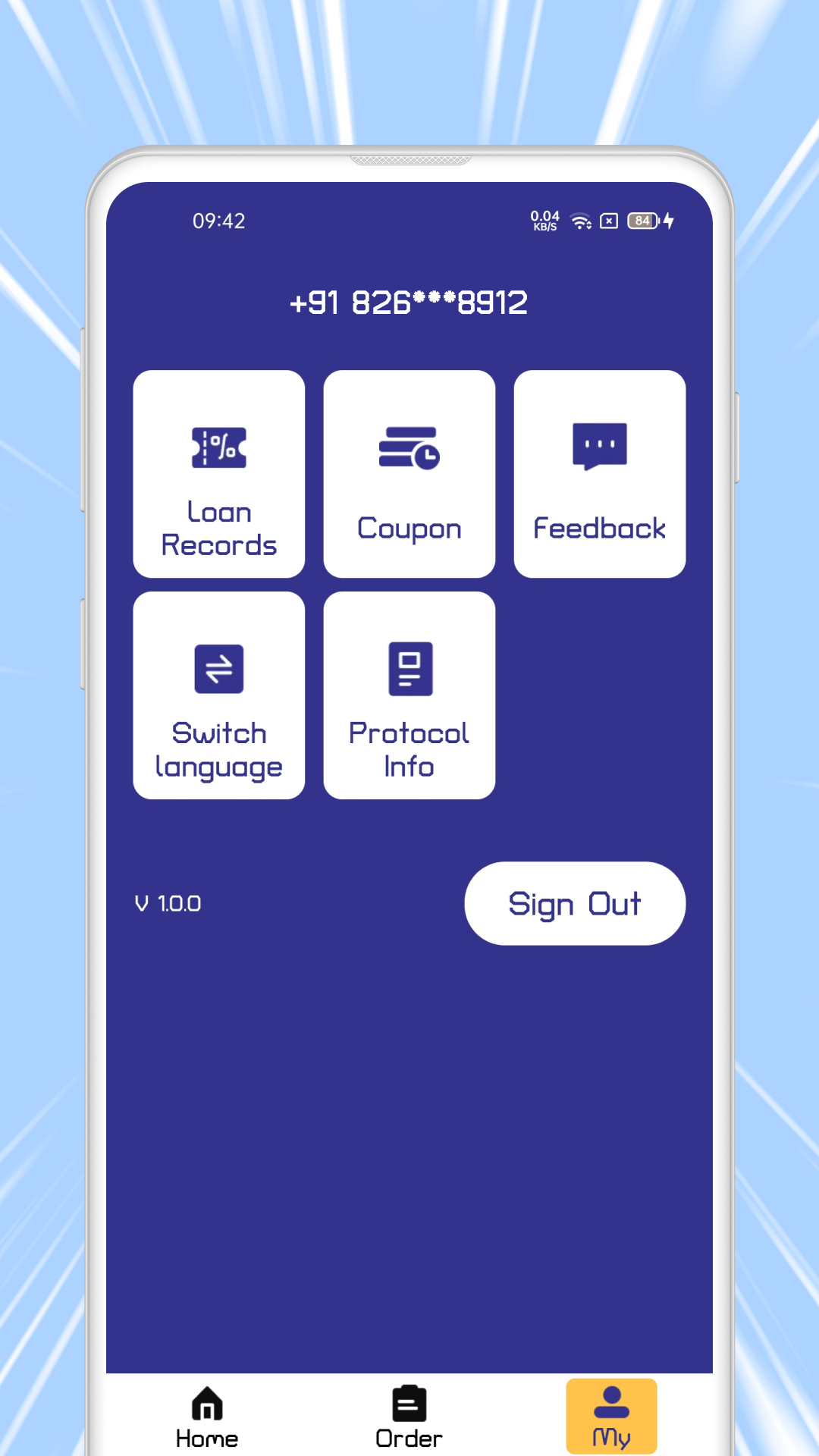

▸ Digital-First Process: Paperless application & real-time tracking

Example Calculation

Principal: ₹20,000 | Tenure: 180 days | Daily Interest Rate: 0.06%

Total Repayable Amount: ₹22,160 = ₹20,000 + ₹20,000 × 0.06% × 180

Regulatory Compliance

✓ Operated with RBI-registered partner: PKF Finance Limited

✓ Compliant with RBI Digital Lending Guidelines (2022)

Security Assurance

🔒 Bank-grade AES-256 encryption

🔒 Data stored exclusively in India

Eligibility Requirements

• Indian residents aged 18+

• PAN card & verifiable income source

• Active Indian bank account

Important Disclosures

⚠ Loan disbursement subject to partner NBFC approval

⚠ Late payments may impact credit score

⚠ Borrow responsibly – avoid over-indebtedness